Things covered in this article

- How to go to the Review settings?

- Settings found in this section Review

- Smart review

- Notification settings for Review

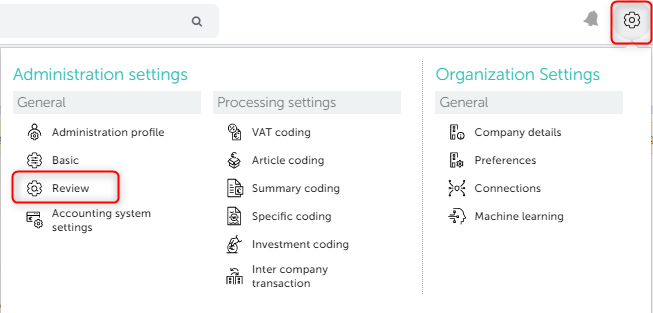

1. How to go to the Review settings?

You can do the settings for Review from Administration settings >> Review. Once you’re in the Review section in Administration settings you will be able to see the settings screen as below- (Login >> Select administration >> Review)

2. Settings found in this section Review

If any of the below setting is turned ON, user will be alerted about it on the Review page/Document detail page

- Ghost invoices– Ghost invoice are the invoices which belong to fraudulent companies.

- Smartbooqing matches invoices with various criterion with details present on Fraudehelpdesk (https://www.fraudehelpdesk.nl/).

- If the invoice details are matched with fraudulent companies, then the respective invoice is considered as ghost invoice.

- Turning this ON/OFF you can restrict on processing the invoices from fraudulent companies. For such kind of documents the alert will be sent out.

How Ghost invoice are detected?

- Ghost invoice detection is based on the following information over document as KvK, IBAN, Name and VAT.

- If any of the above mentioned details are matched with Fraudehelpdesk then the respective invoice is stated as Ghost invoice.

- Once a ghost invoice is detected, you will be notified over Document hub >> review page.

- Comment: Document not processed- Ghost invoice

- i: Onclick of “i” icon, you can view on which parameter the invoice is considered as Ghost invoice.

- Handwritten comments– With this option you can give the option to process the handwritten comments and system will put this kind of docs on the Review page.

- Amounts higher than– Any amount which is more than the entered amount will wait for review on the review page.

- Tax invoices– With this setting, any invoice which is a Tax invoice will be waiting on the review page.

- Amount round off– If lines/ other amounts which have been rounded off by system are higher than the limit set by you then, review comment will be added on the review page.

- Verify IBAN– With this setting if the IBAN on invoice has been received as different from the IBAN what has been registered for this contact a comment is given on the review page.

- Suspense code: If system process document line(s) on suspense code; It will notfiy on review page.

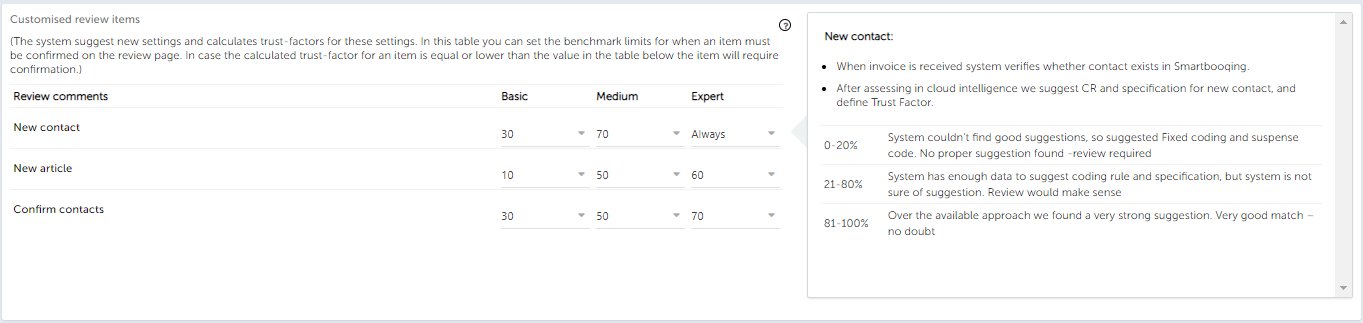

3. Control document review with ‘Smart review’ logic:

-

- By default; you are expert review user. You can change your mode from user list or from account profile.

- You can set the trust factor limit for the items you want to review.

- System calculates surety of contacts in terms of ‘Trust factor’.

- Contacts with lesser trust factor than set here will be sent for your review.

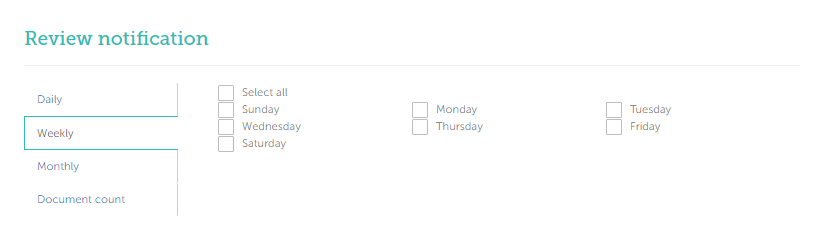

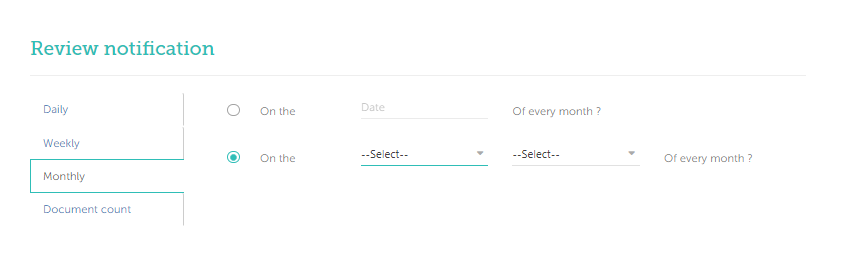

4. Notification settings for Review

You can set the preferences for the review comments, by clicking the ‘Configure’ button from the above screen.

In this section you can do the settings for below options-

- Daily- With this option, every 24 hour notification will be sent by default when this setting is applied. This is sent at 12AM NL time.

- Weekly- With this option, you can set a preferred day, on which the review notification will be sent out.

- Monthly- In this you have two preferences, you can set any date of the month, to receive the review notification or you can choose the day with other preferences.

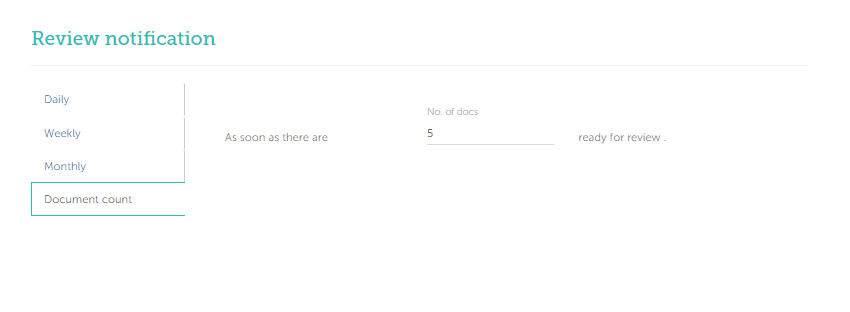

- Document count- You can also put the no. of documents as target so when this entered count is met the review notification will be sent out.